does mississippi pay state taxes

Mississippi has a 700 percent state sales tax rate a max local sales tax rate of 100 percent and an average combined state and local sales tax rate of 707 percent. Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals.

Mississippi State Income Tax Ms Tax Calculator Community Tax

In the state there is no personal income tax and capital gains and dividends are.

. Unlike the Federal Income Tax Mississippis state income tax does not provide. If you are a nonresident of Mississippi your active duty military income is not taxed in Mississippi. The tax rates are as follows.

The State Sales Use tax rate in Mississippi is 7. On top of that. But since Mississippi does not require retirees to pay state income tax on qualified income the.

0 on the first 2000 of taxable income 3 on the. Mississippi residents have to pay a sales tax on goods and services. Mississippi is very tax-friendly for retirees.

However certain localities or towns may charge additional local sales tax. This website provides information about the various. The most significant are its income and sales taxes.

There is an additional convenience fee to pay through the msgov portal. Payment Options Other frequently asked questions found here. You are required to file a Mississippi return and include your active duty pay.

But in Mississippi where the state tax code differs from the federal governments the Department of Revenue plans to tax student loan forgiveness the way it does any form of. Mississippis sales tax rate consists of a state tax 7 percent and local tax 007 percent. Individual Income Tax FAQs.

The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Pay by credit card or e-check. Mississippi income tax rate.

Mississippi has a 900 percent state sales tax rate a maximum local sales tax rate of 100. The state does not tax Social Security benefits income from public or private pensions or withdrawals from retirement accounts. Mississippi Sales and Use Taxes Sales Tax All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the.

The personal income tax which has a top rate of. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or. Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

Road and bridge Privilege Taxes are due upon purchase or renewal of license tags payable to the DOR and vary according to weight age class use mileage apportioned and seating capacity. Mississippi exempts all forms of retirement income from taxation including Social Security benefits income from an IRA income from a 401k and any pension income. The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses.

The Mississippi state government collects several types of taxes. How to Make a Credit Card Payment Income. Franchise Tax All the businesses in Mississippi.

FAQs for Individual Income Tax General Information Technical Bulletins E-File Information Tax Forms Mailing. Mississippi has a combined state and local sales tax rate of 707 percent. The state of Mississippi has low taxes because there are few deductions and exemptions.

The following is intended to provide general information concerning a frequently asked question about taxes administered by the Mississippi Department of. Legislators from both chambers heard from tax expert after tax expert about what repealing the states income tax would mean for Mississippis economy and how a coinciding.

Norquist Mississippi On The Road To Becoming Usa S Tenth No Income Tax State Mississippi Politics And News Y All Politics

Jan 3 2022 Is New Tax Deadline For Folks In 19 Mississippi Counties Hit By Ida Don T Mess With Taxes

Your Guide To Mississippi S Tax Free Weekend 2022

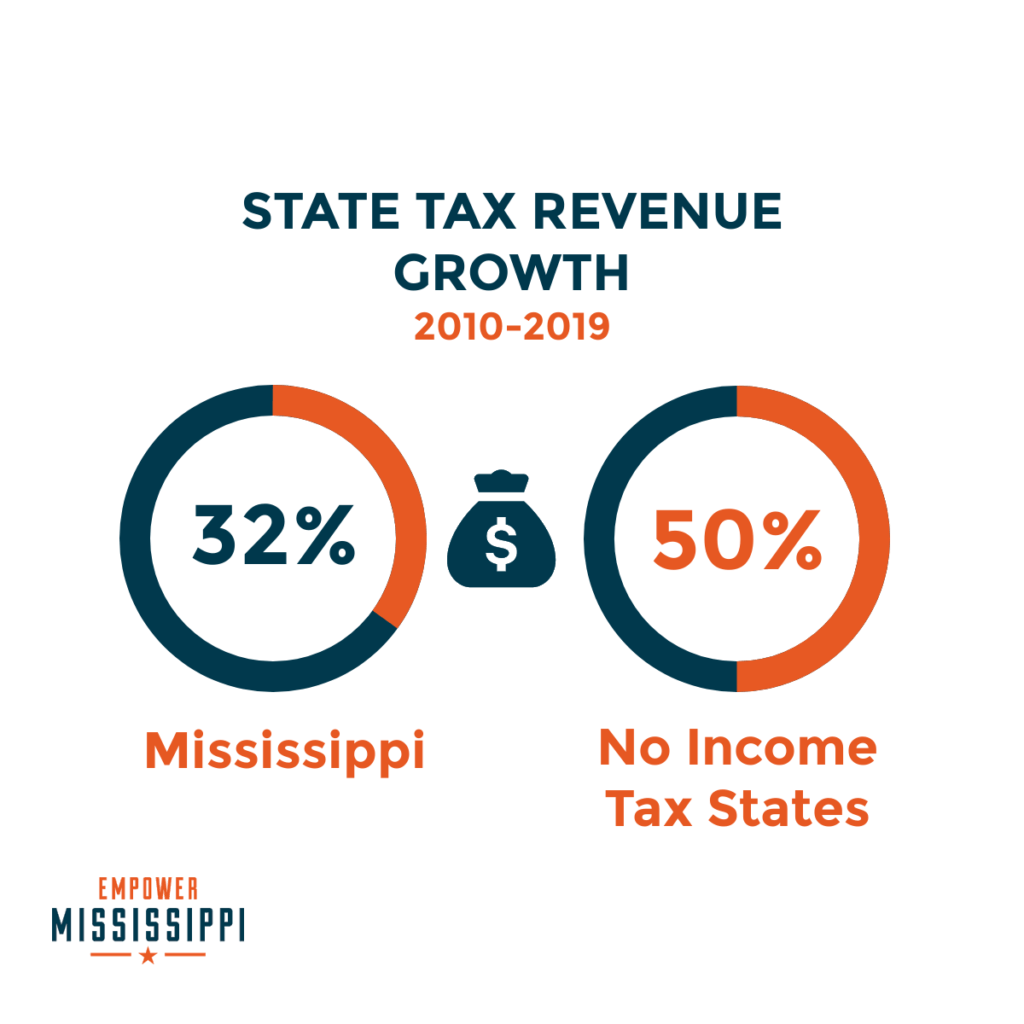

Report In Mississippi Lower Income Means Higher State And Local Taxes

These Are The States Where 100 Goes The Farthest

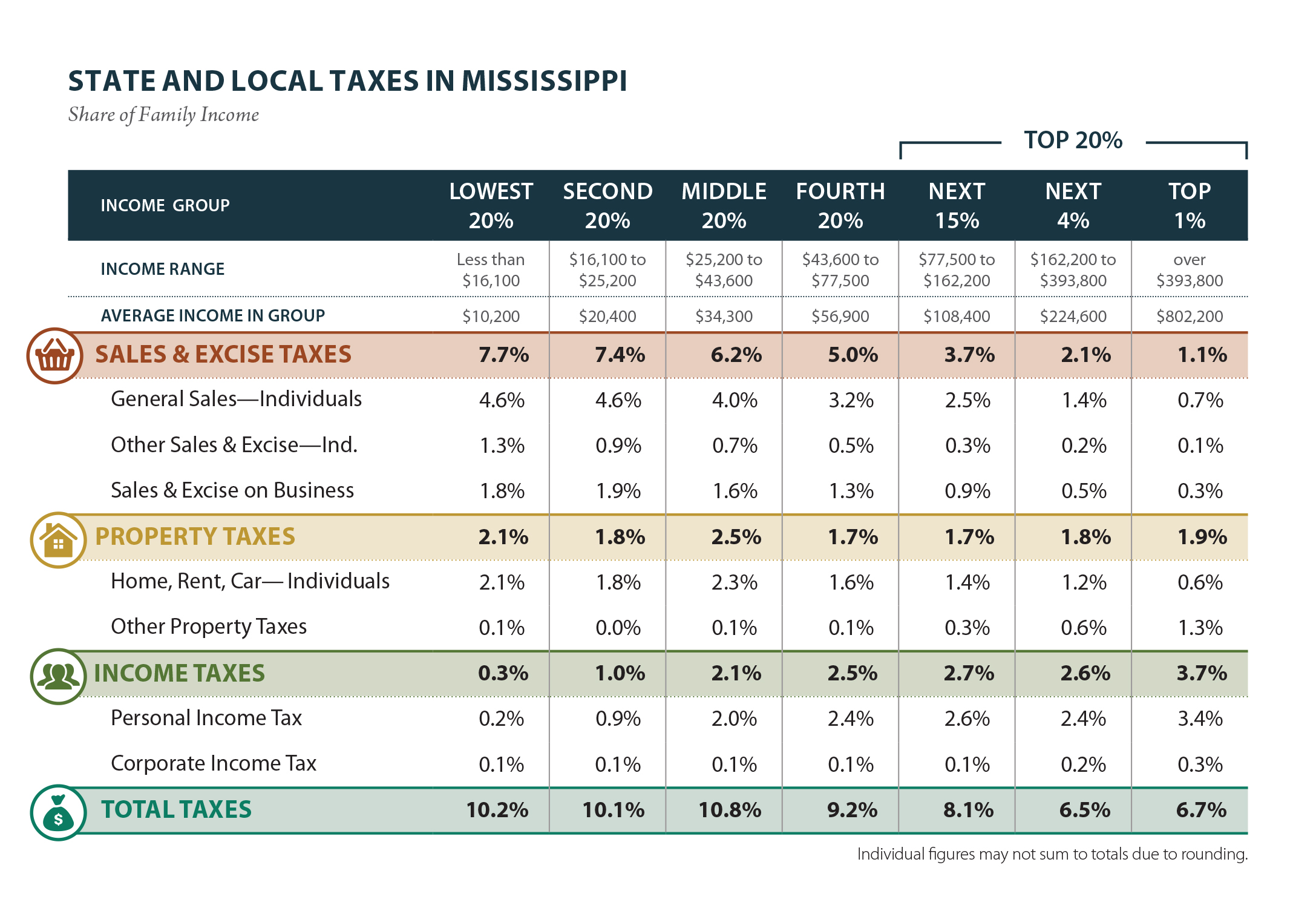

But How Will We Fund Government Without Income Taxes

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Study House Tax Proposal Increases Burden On Poor Mississippians Mississippi Today

Which States Pay The Most Federal Taxes Moneyrates

Study House Tax Proposal Increases Burden On Poor Mississippians Mississippi Today

Mississippi Plans To Tax Student Debt Relief But Paycheck Protection Program Loans Are Tax Exempt Mississippi Today

Mississippi Governor Signs State S Largest Income Tax Cut Mississippi S Best Community Newspaper Mississippi S Best Community Newspaper

Every State With A Progressive Tax Also Taxes Retirement Income

Mississippi State Income Tax Ms Tax Calculator Community Tax

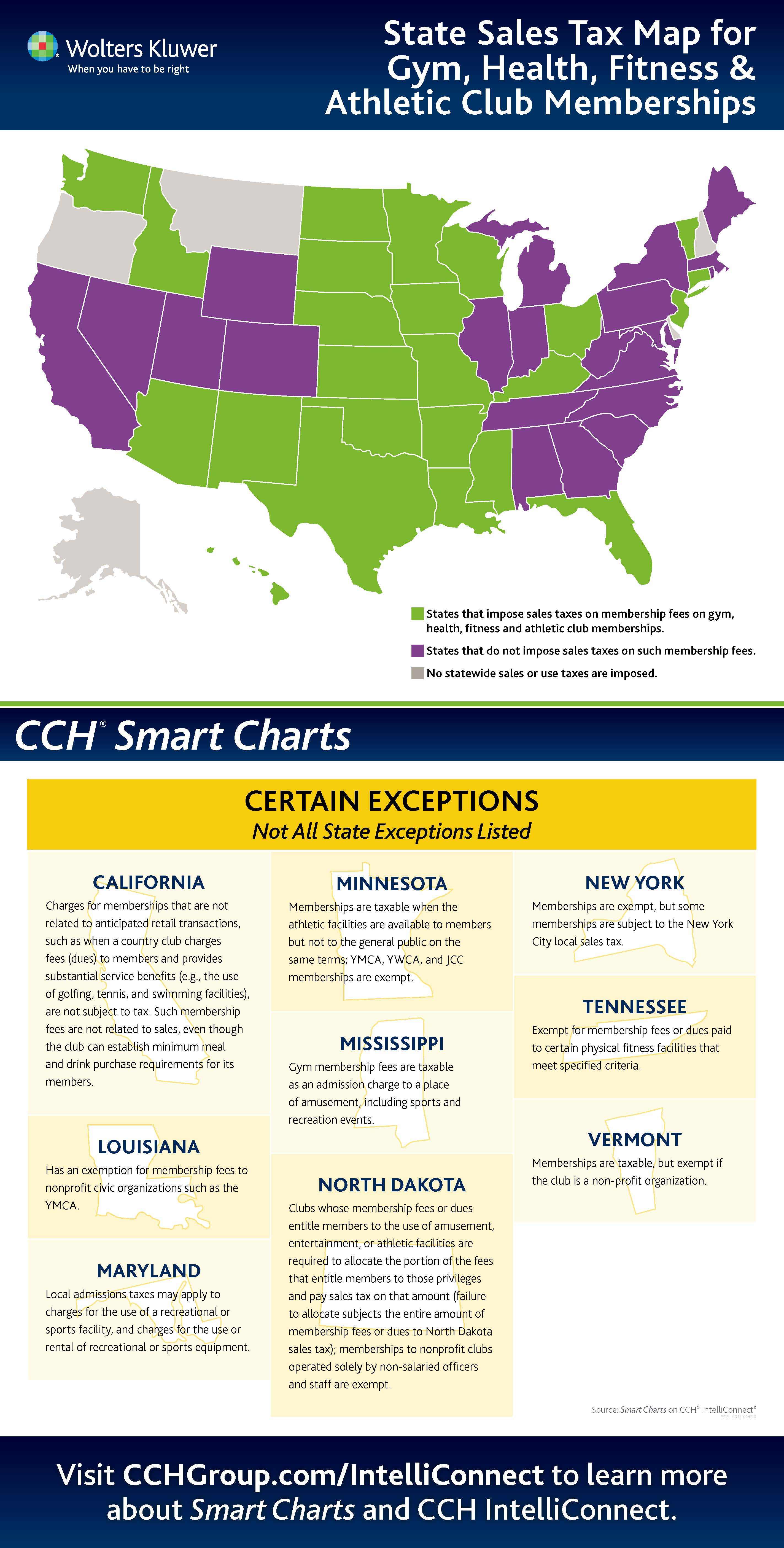

Media Alert Working Out At The Gym Really Can Be Taxing Depending On Where You Live Business Wire

Mississippi Income Tax Reform Details Evaluation Tax Foundation

States With The Highest Lowest Tax Rates

Tennessee Exempted Taxes On Food Mississippi Exempted Taxes On Guns Mississippi Today